The National Social Security Fund (NSSF) ACT No. 45 of 2013 was assented on 24 December 2013 with the effective date of commencement being 10 January 2014 (Download the Act). Consequently, employers are advised to make arrangements to submit their contributions in accordance to the new NSSF Act as outlined below.

Computation Guidelines

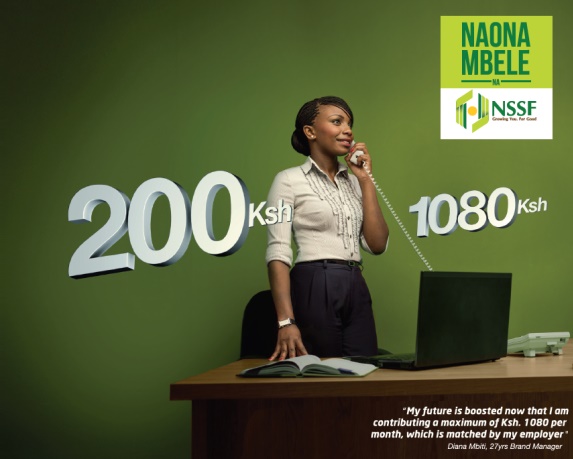

For the purposes of the Act, the Upper Earning Limit (UEL) will be KES. 18,000 while the Lower Earnings Limit (LEL) will be KES 6,000. The pension contribution will be 12% of the pensionable wages made up of two equal portions of 6% from the employee and 6% from the employer subject to an upper limit of KES 2,160 for employees earning above KES 18,000.

The employee contribution shall be drawn directly from his salary and wages while the employers contribution shall come directly from the employer.

The contributions relating to the earnings below the LEL of the earnings (a maximum of KES. 720) will be credited to what will be known as a Tier I account while the balance of the contribution for earnings between the LEL and the UEL (up to a maximum of KES 1,440) will be credited to what will be known as a Tier II account.

Sample Computations are attached below for ease of reference:

Please Note:

The format of the returns file to be submitted to NSSF and the process of submission will remain the same until informed otherwise. The new returns shall contain the Total Pension Contribution (Column 12 above – maximum KES 2,160) in place of the previous Standard Contribution amount of KES 400. The NSSF System will automatically separate the total amount into Tier I and II member contributions. The voluntary column remains the same.