At the National Social Security Fund, we are committed to the highest standards of corporate governance and business ethics. Recognizing that good corporate governance is key to the enhancement of our business performance, the Board of Trustees seek to discharge their duties and responsibilities in the best interest of the Fund, its shareholders, customers, business partners and the wider community.

Our corporate values and ethics are entrenched in our strategic and business objectives and are focused on transforming and accelerating growth in value for the benefit of all our stakeholders.

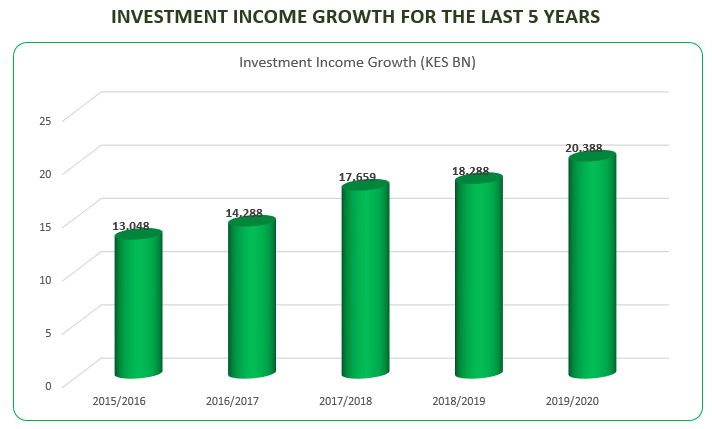

During the year, member contribution declined by 2.4% from Kes. 15.10B in 2019 to Kes. 14.733B in 2020. Benefits Paid to members decreased by 10.2% from kes.4.94 paid in 2019 to kes.4.43B paid in 2020. Similar to the previous year, the investment income increased from Kes.18.28B in 2019 to Kes. 20.33B in 2020. Total operating expenses decreased by 6.2% to Kes.5.407B in 2020 from Kes .5.77B in 2019. The decline in contribution and benefits is attributed to COVID-19 lockdown which affected businesses and movement in the fourth quarter. A net increase in scheme Funds of Kes. 14.5B was achieved in 2020. The Fund’s net assets, therefore, increased by 14% from Kes.235B in 2019 to Kes.250B in 2020.

As shown above, the profitability of the Fund has remained on an increasing trajectory in the last five years.